- Details

- Written by Ian Doust

- Category: mortgages

- Published: 29 July 2015

- Hits: 6482

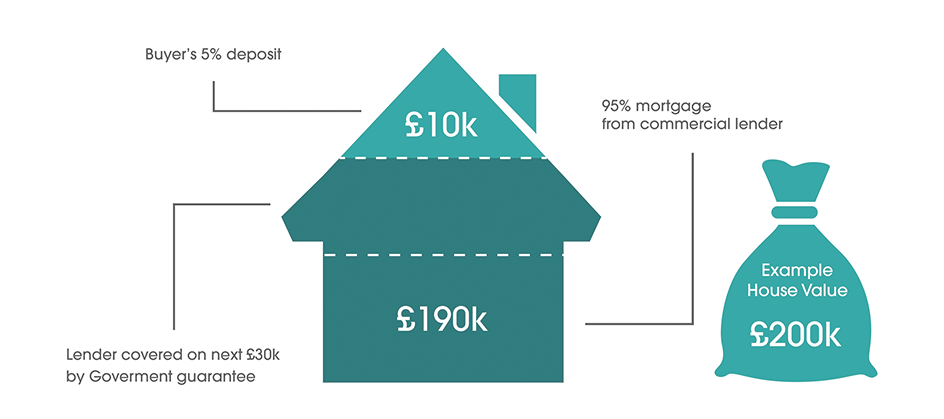

THE MORTGAGE GUARANTEE

The second part of the Government's Help to Buy scheme, the Mortgage Guarantee, is completely different from the Equity Loan. It aims to encourage mortgage lenders to offer more mortgages to people with smaller deposits by making it less risky for them to do so. This part of the scheme does not involve any activeparticipation on the part of the borrower, who should simply benefit from access to a larger number of mortgage deals.

BACKGROUND

In the past there were hundreds of mortgages available at 90% to even 100% 'loan-to-value' (LTV), so if you had a 10%, 5% or even no deposit, there was plenty of choice available. To protect themselves against the risk of borrowers with these smaller deposits 'defaulting' (not making their mortgage payments), lenders traditionally took out insurance called Mortgage Indemnity Cover.

However, in the years lending up to the credit crunch. with most lenders offering higher LTV mortgages, such deals had increasingly become the norm and were considered a reasonable risk for lenders and somortgage indemnity had started to be phased out of the market.

WHY IS THE INDEMNITY IMPORTANT?

Mortgage indemnity could make a big difference if it allows borrowers access to more deals with smaller deposits. In recent years, while a handful of lenders have continued to offer mortgages above 80% LTV. and even up to 90% LTV, because such loans are deemed more risky by underwriters, these higher LTV mortgages have been charged at higher interest rates than home loans under 75% LTV.

The Government has now proposed that it plays the role of the insurer and, as of 1st January 2014, is providing indemnity to lenders offering higher LTV loans, promising to compensate them for part of their losses if mortgage borrowers fail to make their mortgage repayments. This may allow lenders to offer higher rate LTV deals at lower mortgage rates. Note that the indemnity only compensates the mortgage lender if you default on your loan, and offers no help to the borrower .

If you default on your mortgage you still owe the full outstanding balance.

A typical interest rate charged on a 95% mortgage is around 5.25% while the typical interest rate charged on a 75% mortgage is around 2.6%".

BORROWER CRITERIA

•You must be looking to buy your ONLY home, in which you will live.

• Help to Buy is NOT available for buy-to-let investment or the purchase of second homes

•You can be a first time buyer or moving home

•You can have any level of earnings (not restricted to £60.000 per household, as with the previous New Buy Scheme) however, your financial situation will be

assessed to ensure that you are not simply choosing to put down a smaller deposit and/or take out a smaller mortgage than you could otherwise afford on your own

•For the Equity Loan, you must be purchasing a newly-built property on a participating development

•You must have a deposit of at least 5% of the property's value

•You must be able to afford the mortgage.

For Help to Buy Mortgages in

Tel. 0800 612 9505

Tel. 0800 612 9505

- Details

- Written by Ian Doust

- Category: mortgages

- Published: 28 July 2015

- Hits: 6918

Help to Buy Mortgages

Help to Buy is a Government-backed scheme aimed at helping more aspiring homebuyers purchase property. The scheme falls into two parts: an Equity Loan and the Mortgage Guarantee - a type of insurance for mortgage lenders to help them offer more mortgages to people with small deposits.

The Equity Loan is only available to home buyers purchasing new-build properties in England -money has been made available for Scotland, Wales and Northern Ireland to launch their own versions. The insurance part should impact lending throughout the UK.

Professional Mortgage Services is an approved adviser by Help to Buy South West, the Government appointed Help to Buy Agent for South West England and is authorised to carry out financial reviews on their behalf. If you are looking to buy under the Help to Buy scheme you will need a financial review carrying out and should choose an appropriately authorised financial adviser. Contact us for further information.

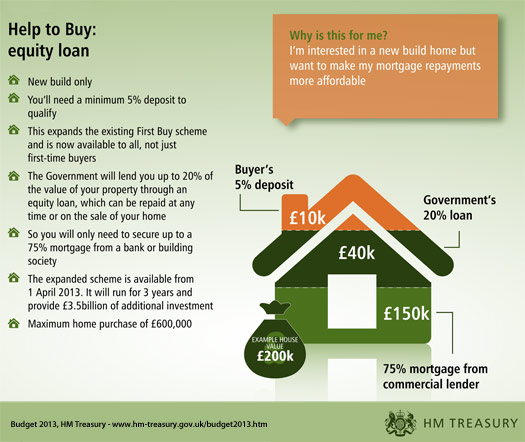

THE EQUITY LOAN

With the Help to Buy scheme you save a minimum 5% deposit, an Equity Loan of up to 20% comes from the Homes and Communities Agency

(HCA), and the remainder (usually 75% of the property's value and up to a maximum of 80%) is covered by a mortgage provided by one of the banks or building societies signed up to the scheme.

You con arrange the mortgage via a mortgage broker or independent financial adviser, or you can visit a branch of. or call, one of the participating lenders and speak to an adviser there. A range of mortgage types are offered by participating lenders including fixed rates (the rate you pay is set for a number of years), and tracker deals (the rate you pay varies in line with the Bank of England Base Rate).

The maximum purchase price for a Help to Buy property is £600,000, so the maximum mortgage loan available is £480,000.

The mortgage lender will carry out the usual checks to ensure that you can afford the mortgage, and are a good credit risk.

HOW DOES THE EQUITY LOAN WORK?

The Equity Loan (NOT the mortgage) is interest-free for the first five years. You make two separate payments: one to the mortgage lender and one to the Government. The Government appointed Local HomeBuy agent will deal with the documentation and arrange the loan.

After five years, you pay the Government 1.75% interest on the loan, rising every year by the level of Retail Price Inflation (RPI currently 2.6%*) plus 1%.

You should be aware that if you default on the payments on your Equity Loan, the Government, which has a legal charge on your property, can pursue you for the money.

You can pay back the loan at any time but you have to repay a minimum of 10% of the amount you owe at a time.

As the Government owns a stake in the equity of your property it shares in any increaso in the value of your home - or any decrease.

If, for example, you have bought a property for £200,000 using a £40,000 Equity Loan (20%). the Government owns a 20% stake in your home. If. say. you sell for £250,000 five years later, the Government gets back 20% of the sale price = £50,000.

WHAT IF THE PROPERTY LOSES VALUE?

If you sell your home and you haven't paid off the loan, you have to pay the Government back Its percentage stake. So, if your property has fallen in value, you have to repay the same proportion of the reduced value.

Using the example above, if you bought for £200,000 with a £40.000 Equity Loan (20%) and sold. say, five years later for £150,000, you will owe the Government 20% of £150.000 = £30.000. That is £10,000 less than you were loaned in the first place and the Government absorbs the loss.

*RPI correct as at October 2013 SOURCE:

- Details

- Written by Ian Doust

- Category: mortgages

- Published: 28 July 2015

- Hits: 6259

Bridging loans guide

Bridging loans are a short-term funding option for property transactions.

What are bridging loans and how do they work?

Bridging loans are designed to help people complete the purchase of a property before selling their existing home by offering them short-term access to money at a high-rate of interest.

As well as helping home-movers when there is a gap between the sale and completion dates in a chain, this type of loan can also help someone planning to sell-on quickly after renovating a home, or help someone buying at auction.

However, rates can be high and there can be hefty administration fees on top.

If you take out a bridging loan, typically, you could face costs of up to 1.5% a month - meaning 18% a year.

Bridging loans are designed to help people complete the purchase of a property before selling their existing home by offering them short-term access to money at a high-rate of interest.

Who are bridging loans aimed at?

Generally speaking, bridging loans are aimed at landlords and amateur property developers, including those purchasing at auction where a mortgage is needed quickly.

When should you use bridging loans?

Bridging loans can be used for a variety of reasons, including property investment, buy-to-let and development.

However, more recently, there has been a growing trend among borrowers to use bridging loans because high street and private banks are taking longer to process applications for larger home loans.

Some borrowers are also viewing bridging loans as a simple alternative to mainstream lending.

While a bridging loan may sound tempting, if you're thinking about taking one out, you need to think carefully about your exit strategy. This might, for example, involve getting a mainstream mortgage or a buy-to-let mortgage, or selling the property altogether.

The problem is, you may not have any guarantee of being accepted for a mortgage with a mainstream lender after having taken out a bridging loan. This could put you at risk of losing your home.

Bridging loans should not be viewed as an alternative to mainstream lending.

Where can you get a bridging loan?

Professional Mortgage Services has access to numerous sources of bridging finance and you will need to contact us to discuss your options.

Professional Mortgage Services is an approved adviser by Help to Buy South West, the Government appointed Help to Buy Agent for South West England and is authorised to carry out financial reviews on their behalf. If you are looking to buy under the Help to Buy shared ownership scheme you will need a financial review carrying out and should choose an appropriately authorised financial adviser. Contact us for further information.

Shared ownership schemes

Shared ownership schemes are provided through housing associations. You buy a share of your home (25% to 75% of the home’s value) and pay rent on the remaining share.

You’ll need to take out a mortgage to pay for your share of the home’s purchase price.

Shared ownership properties are always leasehold.

Eligibility

You can buy a home through shared ownership if:

- your household earns £60,000 a year or less (or £66,000 a year or less in London for a 1 or 2 bedroom property, or £80,000 a year or less in London for a 3 or more bedroom property)

- you’re a first-time buyer (or you used to own a home, but can’t afford to buy one now)

- you rent a council or housing association property

Buying more shares

You can buy more shares in your home any time after you become the owner. This is known as ‘staircasing’.

The cost of your new share will depend on how much your home is worth when you want to buy the share. If property prices in your area have gone up, you’ll pay more than for your first share. If your home has dropped in value, your new share will be cheaper.

The housing association will get the property valued and let you know the cost of your new share. You’ll have to pay the valuer’s fee.

Applying for a shared ownership scheme

To buy a home through a shared ownership scheme contact the Help to Buy agent in the area where you want to live.